Whats the relationship anywhere between a marriage and a mortgage and you will responsibility?

Show this page

I have to concede that in case I tune in to the phrase mortgage, the word marriage is not the to begin with which comes to mind. A similar seriously applies to many consumers regarding a house during the holland, expats specifically.

Imagine having receive your dream home!

Take into account the following state. Immediately after searching all over, you really have finally found the new dream house throughout the Netherlands. You are really delighted as their the new proprietor and plan its interior decorating. not, ahead of being able to take action, product sales processes has to be ended and you can control should be transmitted. If required, the financing of your purchase contribution through a mortgage have to become treated. The whole process of obtaining a mortgage will be exhaustive to possess expats, nevertheless the most readily useful preparing having tomorrow is always to create today’s performs well. So it specifically function another.

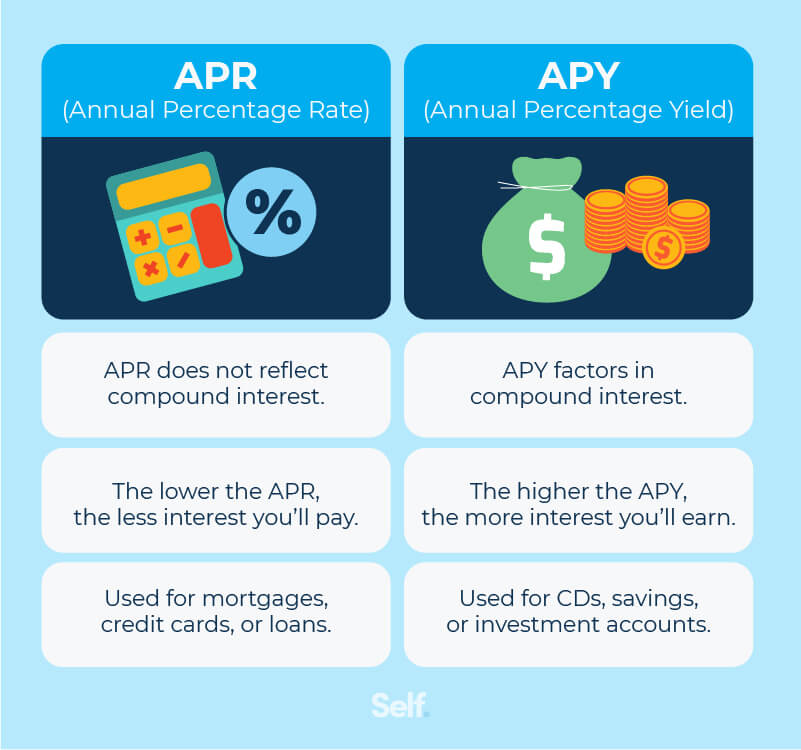

If you are intending when deciding to take a mortgage of good lender to finance the acquisition share, the financial institution tend to ask you to provide some mode away from surety that you’re going to indeed pay back the debt. Ergo, it does ask you to have your home encumbered which have a great home loan due to the fact a right out of safeguards. Ahead of credit you a sum of money, a financial will require about how to keeps a beneficial Dutch resident solution number (in Dutch Burgerservicenummer or BSN) and a home enable. Additionally, the lending company will look at the personal statistics, including the earnings your generate, your you are able to most other bills and you can obligations and your marital condition and you may program.

What if you might be partnered?

More often than not, I am contacted by the a married private, just who originates from overseas and whoever spouse remains based in their residence nation. For example expats are used by a non-political business otherwise an international team in addition they tend to have high wages. The fresh top of their money are, thus, always sufficient towards lender so you’re able to loan all of them money and so they tend to have both an excellent Dutch citizen provider amount and you will a beneficial home permit.

Nevertheless fact that he is married was experienced good reason for doubt for the bank, when evaluating if they will be financing the customer any cash. We quite often score asked because of the clients as to why this is really important. The partners are not co-people, nor are they browsing co-sign the mortgage agreement towards financial, as a result it should not count should your buyer is actually hitched.

Getting married is and may continually be a very online loans in Sugar City Colorado memorable going on. Yet not, partners upcoming spouses realize that their marriage is higher than merely solemnizing the affective relationship. It could together with apply to their monetary relationships and ownership out of qualities they’ve before and you may just after the marriage occasion.

The relationship assets program can get change to the rights from possession!

As soon as your relationships was solemnized from the exposure of one’s bodies in the country for which you get married, a residential area from possessions will come into the existence instantly. This is why, legally, spouses get show specific (otherwise every) possessions and you may sustain specific (otherwise the) debts together, aside from by the who they were acquired otherwise developed during or through to the wedding. Its, thus, a property regime that comes become, whilst partners is almost certainly not alert to they.

From the Netherlands, what the law states claims one to a program off a finite area out of assets applies to spouses wed on Netherlands, in case he’s solemnized the . Principally, this routine states you to definitely what you obtained from the spouses inside the wedding falls to the this group off property and you can, hence, get into all of them as you, with the exception of things among the partners get a good gift or a heredity. Such as for instance gifted otherwise passed down property, and additionally assets in person acquired by the spouses prior to the marriage, are deemed getting individual. This is why a property that is ordered of the certainly the latest spouses physically when you look at the matrimony might also be an associate of your neighborhood from assets, whilst sales price age of just one of your own spouses.

Up until the step one st off , an over-all society out-of property is relevant, and so the spouses would visited individual every property and you will incur most of the obligations jointly due to the marriage, no matter if these people were gotten otherwise contracted throughout the otherwise just before the wedding.

In case the upcoming spouses desire to deflect from the courtroom important regarding a marital community from possessions, capable draft an excellent pre (-otherwise post)nuptial arrangement early in the day (prenuptial) otherwise during (postnuptial) the wedding, where spouses identify if you will find in fact a community regarding possessions between the two.

Be mindful of foreign rules

Its common to possess expats who started to the netherlands so you can performs and you will real time here to track down partnered overseas (have a tendency to prior to its coming from the Netherlands). They generally started alone and they are have a tendency to with their loved ones members later on. Typically, Dutch legislation doesn’t apply at this new relationship assets regime out-of including expats and it may feel stressful to enable them to has ascertained and therefore rules is applicable in cases like this.

Due to the fact relevant rules is set, it needs to be determined perhaps the marital assets program contains a good people regarding assets or whether or not the spouses keep their unique property just after matrimony celebration.

Having (drawn up) a beneficial (pre- or blog post)nuptial agreement may shed certain white on these circumstances, but businesses (such as the mortgage bank) constantly are not told out-of (new judge consequences away from) the brand new specifications included in the (pre- or postnuptial)contract in accordance with the applicable international laws. Often, lacking an excellent (pre-otherwise article)nuptial contract is the correct service, as the financial lender could possibly get request the consumer to present good report made by a good Dutch notary in which is mentioned just what new legal outcomes of the fresh new relevant foreign law is when here are a (pre- otherwise blog post)nuptial arrangement present. Its, thus, vital that you get in touch with an international minded notary to ascertain exactly what means become done.

Stay in the future and avoid issues

To close out, a wedding (otherwise joined relationship) can be alternatively tied to (the procedure of making an application for and acquiring) a mortgage. Whenever starting a mortgage loan app, just be wary of the consequences the wedding might have on the possibility of in reality getting the financing.

It is important to contact a beneficial Dutch civil-law notary company to avoid people judge problems of developing as soon as you are able to in this techniques. Just like the an international situated notary corporation, we could show you in this count.

Author: Joep Ertem, LL.Meters.

o n an array of judge sufferers. He focuses on the fresh new drawing up regarding (living) wills and you can installing income tax arrangements to avoid way too many burdens, also advising international readers toward issues in which friends rules and you may real estate law convergence.

His objective is to try to do and continue maintaining a bond out-of believe together with his members, he considers a requirement to come quickly to the right solution to legal issues.