The straightforward Way of getting a property Collateral Mortgage During the BC, Which have Poor credit

Bad credit? Delivering a house Security Mortgage Remains You’ll be able to!

Discussing less than perfect credit ? You happen to be questioning when there is a way to rating a house guarantee financing . Or if you qualify for example at all…

Have a tendency to a low credit score allow you to pull equity out of your house and employ it to possess renovations, a household travel, otherwise your own daughter’s wedding?

The solution to many of these concerns is Sure! You can be eligible for domestic collateral resource despite smaller-than-prime borrowing . We will guide you why (despite exactly what of numerous people envision) taking a property equity financing whenever dealing with poor credit normally be less problematic when you are handling the proper mortgage broker and greatest personal loan providers in the Vancouver .

Use the first step into the unlocking your own home’s guarantee confidently. Contact you to own a zero-responsibility appointment and commence flipping debt wants to the reality. Phone call 778-839-3963 or email address today!

House Security Loans Standard Guidelines

If you’re looking to get a home security financing but have poor credit, you will find several points to consider before you apply with A good-loan providers.

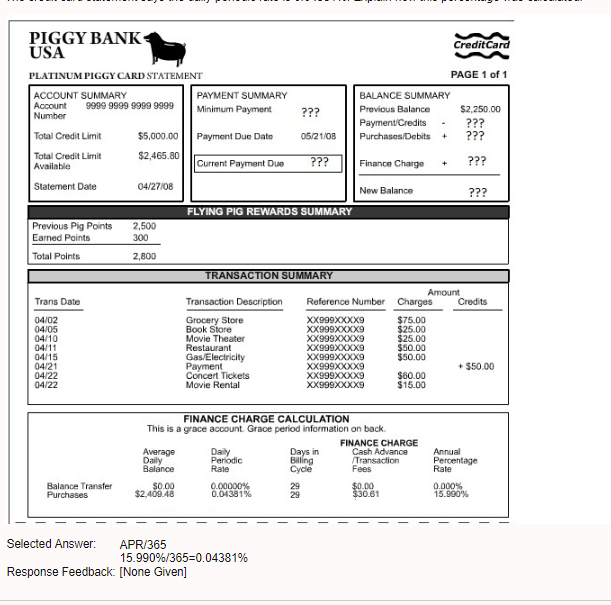

Except for demanding a credit rating higher than 620, finance companies will also want to look at the mortgage-to-worth ratio, debt-to-earnings ratio, along with your proven capability to repay the mortgage. To locate a better knowledge of just what all these requirements imply, let us familiarize yourself with all of all of them individually:

- Credit score Which have a credit history is a vital basis for finance companies to help you accept each other family security finance and house guarantee contours from credit. Your credit rating try calculated if you take into consideration issues like the debt and you will payment background, the newest wide variety owed, length of credit score, or the particular credit lines unwrapped such credit cards otherwise unsecured loans. Usually, the highest weight could be apply the degree of financing you own and you can whether you’ve been paying the debt rate within the day. The degree of loan owed plus percentage history often account for approximately 60-65% of your own entire credit history.

Which have bad credit means you probably generated some errors throughout your credit score, therefore actually have a credit rating off less than 620. Which reasonable credit score might have been for the reason that of several items such being many times later having mortgage payments, bypassing bank card money, that have already made use of more 31% of the credit limit, or which have got a last bankruptcy proceeding.

- Loan-to-really worth proportion financing so you’re able to worth proportion is the difference in everything you are obligated to pay in your financial or your loan matter as well as your home’s well worth and you will determines whether or not you’ve got adequate security of your home so you can be eligible for the best lender cost.

- Debt-to-earnings proportion your debt so you can earnings proportion is illustrated by your disgusting month-to-month money split up by your entire month-to-month obligations repayments. A debt ratio more important than simply or equal to forty% will generally qualify your just like the a leading-exposure debtor to own banks.

- Loan fees lower than this laws, the financial institution tries to know if the fresh borrower is pay a loan by thinking about points such as most recent monthly earnings or assets, work position, job stability, present debt obligations, or credit rating. When comparing these types of items, A-lenders will usually additionally use third-group suggestions to ensure all installment long rerm loans no credit check Denver CO the details.

Enhancing your Likelihood of Delivering a property Collateral Loan Which have Bad Borrowing from the bank

As you can see by now, working with high street lenders with less than perfect credit tends to make delivering property collateral loan extremely difficult. Unless you’re the best-on-papers brand of debtor, every requirements you to definitely banking institutions demand can also be frighten aside really prospective people.