The issue merchandise particular quandaries on HBCUs in which use of such funds try ideal

Which report provides the newest analyses out-of various research source to know just how Mother Together with has morphed away from a distinct segment system getting middle-group families on the an operating cause for some of the terrible results for parents whom located government figuratively speaking, and particularly to have Black group

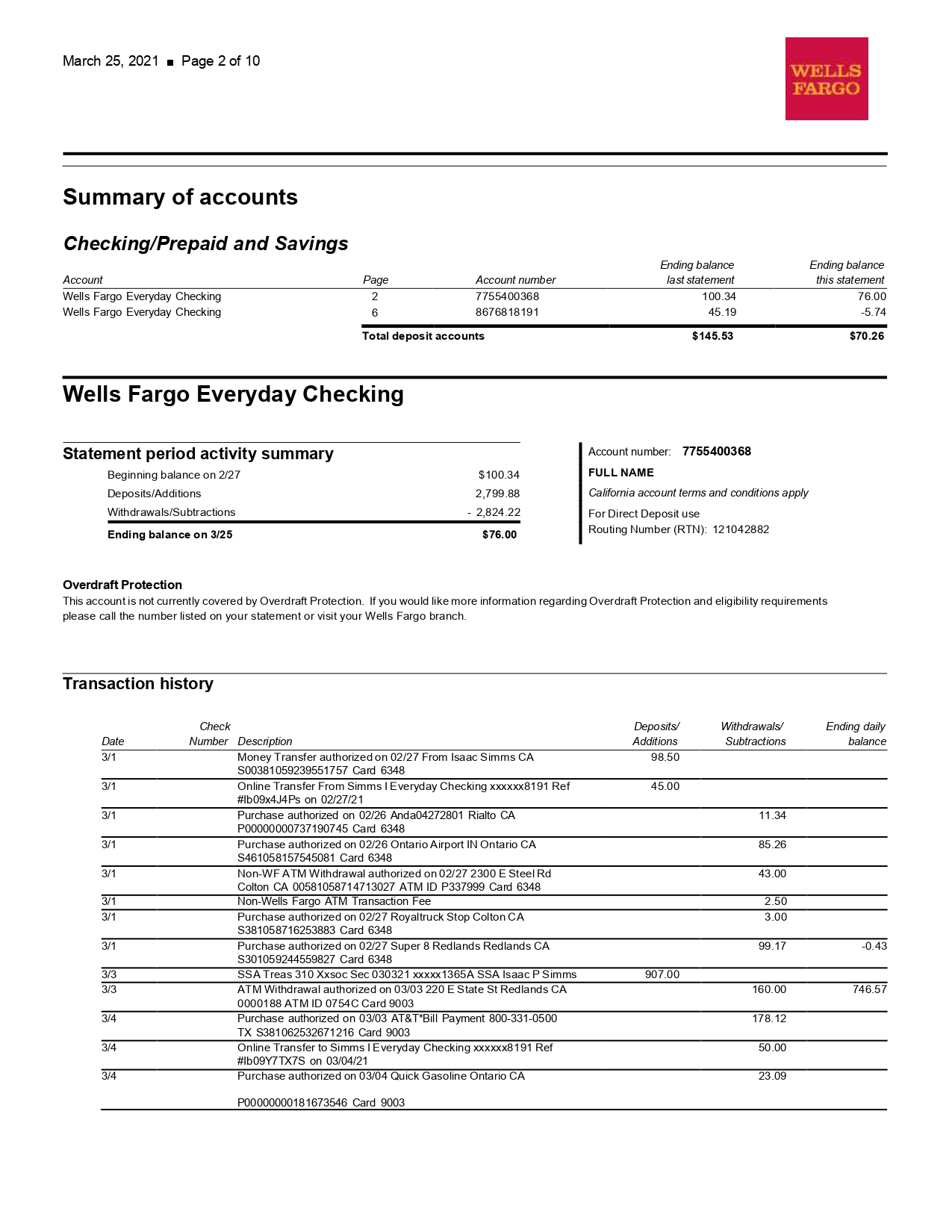

- The brand new show of Black colored Mother or father Together with individuals whoever families keeps thus little wealth otherwise money you to definitely their asked family relations sum (EFC) so you can a college education (since determined from the You.S. Institution away from Education) are zero rose off fifteen per cent in 2008 to help you an astounding 42 percent in the 2018. The fresh express for the same Latino/a pops As well as consumers is also higher, exceeding 25 %.

- Sixty-seven associations tell you 10 percent off parents otherwise fewer making progress once 36 months. Fifty-9 ones-almost ninety %-is HBCUs.

- A decade after doing fees, the parents which received Parent In addition to loans along with pupils probably the big colleges for Black colored enrollment still owe typically 96 per cent of their prominent, compared to the 47 % those types of whose youngsters attended the big colleges having white subscription.

- More Black mothers (33 %) and you can Latino/a parents (30 %) whom keep figuratively speaking for their kids’ education and keep pupil loans due to their own degree, compared to the merely 13 per cent certainly light parents whom hold these money. 7

- In the few days they were interviewed, 37 percent out-of Black father or mother-individuals told you they anticipated to be unable to generate a partial percentage on their education loan debts, as compared to 20% for everyone almost every other teams. 8

Given that lower-earnings families, and particularly Black and you may Latino/a moms and dads, was disproportionately taking out Parent And additionally finance, their heavier play with and you may unfavorable fine print exacerbate new racial riches gap.

Two big ramifications to have coverage arise. The very first is one one greater action by Biden administration to help you terminate federal college student loans should include brand new household already involved by loans on account of Father or mother In addition to money. A wave off forgiveness, eg $10,000 per borrower, create alter the lives out-of thousands of troubled moms and dads. Though the full information on the program aren’t yet personal and you may possibly inside flux during it report’s book, it is vital that the forgiveness be achieved towards a good for each and every borrower base, not good for every scholar foundation, to just take these types of mothers.

Inclusion

The way group purchase the newest costly nonetheless-ascending price of school is evolving, having parents taking up an increased show of the economic weight, funded owing to loans. Along side surroundings from student studies, reliance on the brand new federal Father or mother And additionally program has exploded remarkably for the the past twenty years. Take into account the following:

So it statement will bring the analyses from a range of data source to know how Mother Also has actually morphed out of a niche system getting middle-category household into the an operating reason for some of the bad outcomes for family which receive government college loans, and especially having Black family

- Just before subscription declines due to the newest COVID-19 pandemic, annual Father or mother In addition to disbursements all over the country got tripled from about $5 mil in 2000 to over $15 billion because of the 2016, motivated primarily by the a beneficial 269 per cent boost in the play with getting attendance in the personal universities. ten (Get a hold of Shape step one.)

- On Colorado A&Meters Program, one of the largest personal university solutions in the united kingdom, annual Father or mother As well as mortgage check loans Copper Mountain CO totals flower from $56 million to help you $253 mil anywhere between 2009 and you will 2019. eleven

- At certain high to have-money colleges, Father or mother As well as is the reason the majority of the educational funding acquired from the undergraduates. several

- Utilization of the Mother or father Along with program may differ generally. Even though some colleges seldom discover their youngsters discovered such funds, mothers whoever students possess attended Penn State University by yourself are holding $step one.cuatro mil in the outstanding financial obligation. thirteen

- The U.S. Department out of Degree prices you to definitely between fifty percent and you may 55 per cent out-of undergraduates on Clark Atlanta College located Moms and dad Also fund. fourteen Put another way, on Clark Atlanta College or university, this new undergraduate inhabitants enjoys a great deal more Mother Including readers than simply non-readers.