Transfers for Payroll Expenses

Content

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Salary refers to a set amount of payment that does not change throughout the year and is usually quoted as an annual sum rather than hourly. With salaried jobs, there is no set amount of hours an individual works, so if the person works 40 hours a week or 60 hours a week, there is no difference in pay. And hopefully you are using what we consider the best accounting software for startups, QuickBooks Online.

- Automating payroll processing can reduce payroll expenses while eliminating errors and improving the experience for your team, both at home and internationally.

- As with employees, there are many ways to pay international contractors, including through Remote, bycheck, direct deposit, PayPal or Venmo, and more.

- If you are required to participate in the PrompTax program for New York State withholding tax you must make your MCTMT payments using the PrompTax program.

- Currently, employers pay a 6.2% Social Security tax and a 1.45% Medicare tax (7.65% in total).

Statutory fringes are counted as payroll expenses only when they’re paid by the employer, and not deducted from the employee’s compensation. Furthermore, it also includes the amount your business pays in taxes to federal, state, and local agencies based on gross payroll figures. However, the tax withholdings from employee paychecks are not included in your payroll expenses since they’ve already been included as part of gross wages. The payroll expense tax applies to the compensation of each Seattle employee that equals or exceeds $150,000. The definition of “employee” includes individuals who are treated as independent contractors for purposes of Seattle business license tax. Compensation paid in Seattle to an independent contractor whose compensation is included in another business’ payroll expense are exempt from the payroll expense tax. The tax rate ranges between .7% and 2.4% and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business.

Transfers for Payroll Expenses

Because of this, worker compensation insurance rates for these employees can be as high as 15% of wages. On the other hand, the office staff of the meat packing plant—provided that they do not spend time in the production area—may have a rate that is less than 1% of salaries and wages. Unlike payroll expense, the cost of labor also includes the amounts paid to contract labor. An independent contractor provides work for your business when needed, but they are not an employee.

Accounting for payroll gives you an accurate snapshot of your expenses. Since payroll expenses can be a significant expense for your business, you must know how to manage your payroll expenditures shrewdly. Equally, if you don’t understand all the expenses related to your business, your cost of labor can grow out of control. At The Payroll Department, we’re found that managing payroll expenses can be a difficult aspect for some small business owners when it comes running a business. Plus, several business owners have trouble determining the price of their products when it comes to their cost of labor and other expenses.

How do you account for payroll Expense (Wages) and payroll Taxes in QuickBooks?

In a cash basis company, payroll expense is the cash paid during an accounting period for salaries and wages. In an accrual basis company, payroll expense is the amount of salaries and wages earned by employees during the period, whether or not these amounts were paid during that period.

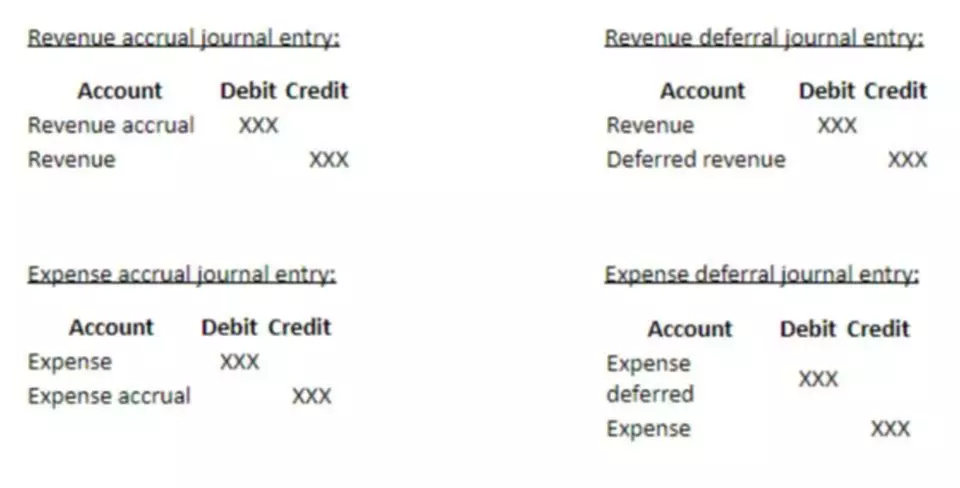

What is the entry for accrued payroll?

Accrued payroll is entered as a debit entry to record the employee payroll expense, representing the amount of total earnings employees have accumulated for the work they do as of the end of an accounting period.

In 2022, when the employee takes the vacation earned in the previous year, the employer records the gross amount of the vacation check with a debit to Vacation Liability . Many companies pay their permanent employees for holidays such as New Year’s Day, Memorial Day, July 4th, Labor Day, Thanksgiving, and Christmas. It is not unusual for employees to be paid for 10 holidays per year. It is also common for employees to earn one week of vacation after one year of service. Many employers give their employees two weeks of vacation after three years of service, with more weeks given after 10 years of service. For example, if an employee earns $40,000 of wages, the entire $40,000 is subject to the Social Security tax.

Journal entry #1

For any month with Total payroll expenses greater than Fixed Payroll Expenses, the excess amount of Total Payroll Expenses will be considered variable expenses. Variable portion of salaries, calculated as described below in the definition of Fixed and Variable Payroll Expenses. Devra Gartenstein is an omnivore who has published several vegan cookbooks. To learn more about payroll, our resource hub has plenty of articles that can help you. Expert advice and resources for today’s accounting professionals. The tools and resources you need to take your business to the next level. The tools and resources you need to run your business successfully.

- This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business.

- More and more workers are remote and on the move, so you might need to understand the rules for more than one country for each worker.

- We consolidate payroll processing with a variety of solutions for managing and paying your global workers.

- With Remote IP Guard, you can rest easy knowing your IP is protected all around the world.

- In a cash basis company, payroll expense is the cash paid during an accounting period for salaries and wages.

Processing payroll requires a company to complete several steps and calculate withholdings for employees. The accrual method allows you to match payroll expenses with revenue and posts payroll expenses and liabilities in the same period. Use a payroll solution to process payroll and avoid manual calculations. Payroll can change frequently, so document your payroll process to save time. The term “payroll expense” means compensation paid to a Seattle employee.

If they go over the set amount of hours, then they are usually paid overtime. Overtime pay can sometimes be higher than the regular hourly pay; sometimes 1.5x the hourly pay. To illustrate, assume that an employee works full-time for the entire year 2021 and as a result earns one week of vacation to be taken anytime during the year 2022. In the weeks/months of the year 2021 , the employer debits Vacation Expense and credits Vacation Liability.

Therefore, we want to take this opportunity to answer some basic questions small business owners may have about payroll expense and cost of labor. Transfer expenses do not include preexisting obligations of the payee that are payable for the payee’s account from the proceeds of a transfer. Payroll Expensesmeans wage, salary, benefit, payroll tax, worker’s compensation and other direct expenses incurred by Aegis in employing personnel to provide the Services.

Payroll Taxes, Costs, and Benefits Paid By Employers

Permanent establishment is a tax designation given to businesses that are deemed sufficiently established to pay corporate taxes in another country. Even if you do not have full-time employees in the country, your contractors may trigger permanent establishment depending on the type of work they do and how much authority they exercise on your behalf. Learn more about permanent establishment risk in our helpful article on the subject. Misclassifying https://www.bookstime.com/ an employee as a contractor means you avoided paying statutory payroll taxes for that employee. In addition to the taxes, you may also be liable for penalties and late fees as a result of non-payment. Costs get even steeper when you multiply by the number of infractions and the number of years the worker was misclassified. A wage expense has to at least be equal to the minimum wage dictated by the federal government or the state government.